|

||||

Working Papers Banks and the State-Dependent Effects of Monetary Policy (with Martin Eichenbaum , Federico Puglisi, and Mathias Trabandt), 2025. Regulating Artificial Inteligence (with Joao Guerreiro and Pedro Teles), 2025. Foreign Residents, and the Future of Global Cities (with Joao Guerreiro and Pedro Teles), 2024.

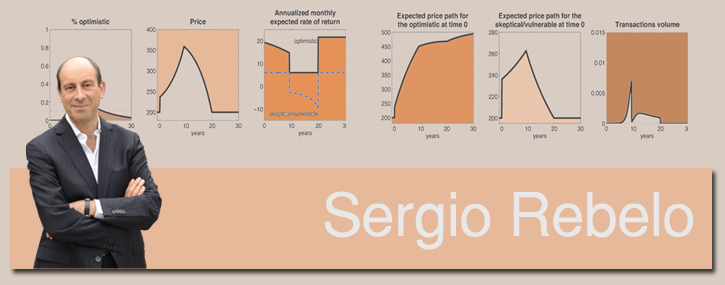

Published Papers Markups Across Space and Time (with Eric Andersen and Arlene Wong), forthcoming, Review of Economic Studies, 2025. Behavioral Sticky Prices (with Miguel Santana and Pedro Teles ), forthcoming, Journal of Monetary Economics, 2025. Expectations, Infections, and Economic Activity (with Martin Eichenbaum, Miguel Godinho de Matos, Francisco Lima and Mathias Trabandt), Journal of Political Economy, 2024. A World Equilibrium Model of the Oil Market (with Gideon Bornstein and Per Krusell), The Review of Economic Studies, 2023. State Dependent Effects of Monetary Policy: the Refinancing Channel (with Martin Eichenbaum and Arlene Wong), American Economic Review, 2022. The Macroeconomics of Epidemics (with Martin Eichenbaum and Mathias Trabandt), The Review of Financial Studies, 2021. Should Robots be Taxed? (with Joao Guerreiro and Pedro Teles), Review of Economic Studies, 2021. Rare Disasters, Financial Development, and Sovereign Debt (with Neng Wang and Jinqiang Yang), Journal of Finance, 2021. Epidemics in the New-Keynesian Model (with Martin Eichenbaum and Mathias Trabandt), Journal of Economic Dynamics and Control. The Macroeconomics of Testing and Quarantining (with Martin Eichenbaum and Mathias Trabandt), Journal of Economic Dynamics and Control. Inequality in Life and Death (with Martin Eichenbaum, Mathias Trabandt), IMF Economic Review. Monetary Policy and the Predictability of Nominal Exchange Rates (with Martin Eichenbaum and Ben Johannsen), Review of Economic Studies, 2020. What is the Optimal Immigration Policy? Migration, Jobs and Welfare (with Joao Guerreiro and Pedro Teles), Journal of Monetary Economics, 2020. Trading Up and the Skill Premium (with Nir Jaimovich, Arlene Wong, and Miao Ben Zhang), NBER Macroeconomics Annual, 2019. Trading down and the business cycle (with Nir Jaimovich and Arlene Wong) Journal of Monetary Economics, 2019. The Portuguese Crisis and the IMF (with Martin Eichenbaum and Carlos Resende) in M. Schwartz and S. Takagi (eds.) Background Papers for The IMF and the Crises in The IMF and the Crises in Greece, Ireland, and Portugal, International Monetary Fund, 2017. Non-Linear Effects of Taxation on Growth (with Nir Jaimovich), Journal of Political Economy, 2016. Understanding Booms and Busts in Housing Markets (with Craig Burnside and Martin Eichenbaum), Journal of Political Economy, 2016. Valuation Risk and Asset Pricing (with Rui Albuquerque and Martin Eichenbaum), Journal of Finance, 2016. Long-run Bulls and Bears (with Rui Albuquerque, Martin Eichenbaum and Dimitris Papanikolaou), Journal of Monetary Economics, 2015. How Frequent Are Small Price Changes? (with Martin Eichenbaum, Nir Jaimovich, and Josephine Smith), American Economic Journal, Macroeconomics, 2014. What Explains the Lagged-Investment Effect? (with Janice Eberly and Nicolas Vincent) Journal of Monetary Economics, May 2012. Carry Trade and Momentum in Currency Markets (April 2011, with Craig Burnside and Martin Eichenbaum), Annual Review of Financial Economics, 2011. Data for payoffs to carry trade and momentum is available here. When is the Government Spending Multiplier Large? (with Lawrence Christiano and Martin Eichenbaum), Journal of Political Economy, 2011. Do Peso Problems Explain the Returns to the Carry Trade? (Craig Burnside, Martin Eichenbaum, and Isaac Kleshchelski), Review of Financial Studies, 2011. Reference Prices, Costs and Nominal Rigidities (with Martin Eichenbaum and Nir Jaimovich).Data Appendix, American Economic Review, 2011. Can News about the Future Drive the Business Cycle? (September 2008, with Nir Jaimovich), American Economic Review, 2009. News and Business Cycles in Open Economies (with Nir Jaimovich), Journal of Money, Credit and Banking, 2008. When Is it Optimal to Abandon a Fixed Exchange Rate? (with Carlos Vegh ) Review of Economic Studies, 2008. The Returns to Currency Speculation in Emerging Markets (2007, with Craig Burnside, and Martin Eichenbaum), American Economic Review, 2007. Behavioral Theories of the Business Cycle (with Nir Jaimovich), Journal of the European Economic Association, 2006. Modeling Exchange Rate Passthrough After Large Devaluations (with Ariel Burstein and Martin Eichenbaum), Journal of Monetary Economics, 2006. Large Devaluations and the Real Exchange Rate (with Ariel Burstein and Martin Eichenbaum), Journal of Political Economy, 2005. Data and replication materials. How Important Are Nontradable Goods Prices As Sources of Cyclical Fluctuations in Real Exchange Rates? (with Ariel Burstein and Martin Eichenbaum), Japan and the World Economy, 2006. Currency Crisis Models (with Craig Burnside, Martin Eichenbaum). The New Palgrave, 2nd Edition, 2007. Government Finance in the Wake of Currency Crises with Craig Burnside and Martin Eichenbaum ), Technical Appendix, Journal of Monetary Economics, 2006. Real Business Cycle Models: Past, Present and Future, Scandinavian Journal of Economics, 2005. Currency Crises and Fiscal Sustainability (with Craig Burnside and Martin Eichenbaum) in Craig Burnside (ed.) Fiscal Sustainability in Theory and Practice: A Handbook, Washington, DC: World Bank, 2005. Investment Prices and Exchange Rates: Some Basic Facts (with Ariel Burstein and Joao C. Neves), Journal of the European Economic Association, 2004. Government Guarantees and Self-Fulfilling Speculative Attacks (with Craig Burnside and Martin Eichenbaum ) Journal of Economic Theory, 2004. (Technical Appendix ) Distribution Costs and Real Exchange Rate Dynamics During Exchange-Rate-Based Stabilizations (with Joao C. Neves ), Journal of Monetary Economics, 2003. Production, Growth and Business Cycles: Technical Appendix , (with Robert King and Charles Plosser ), Computational Economics, 2002. On the Fiscal Implications of Twin Crises (with Craig Burnside and Martin Eichenbaum ) Prospective Deficits and the Asian Currency Crises (with Craig Burnside and Martin Eichenbaum ), Journal of Political Economy, 2001. Beyond Balanced Growth (with Piyabha Kongsamut and Danyang Xie ), Review of Economic Studies, 2001. Equilibrium Unemployment (with Joao Gomes and Jeremy Greenwood) Journal of Monetary Economics, 2001. Hedging and Financial Fragility in Fixed Exchange Rate Regimes (with Craig Burnside and Martin Eichenbaum) European Economic Review, June 2001. On the Dynamics of Trade Reform (with Rui Albuquerque), Journal of International Economics, 2000. Understanding the Korean and Thai Currency Crises (with Craig Burnside and Martin Eichenbaum) Federal Reserve Bank of Chicago's Economic Perspectives, 2000. Resuscitating Real Business Cycles (with Robert King) in John Taylor and Michael Woodford (eds.) Handbook of Macroeconomics, North-Holland, 2000. The Role of Knowledge and Capital in Economic Growth in Matti Pohjola (ed.) Information Technology and Economic Development , Wider, United Nations, 2000. “What Caused the Recent Asian Currency Crises?,” (with C. Burnside, and M. Eichenbaum), “On the Optimality of Interest Rate Smoothing,” (with D. Xie), Journal of Monetary Economics, 43: 263-282, 1999. “Sectoral Solow Residuals,” (with C. Burnside and M. Eichenbaum) European Economic Review, 40: 861-869, April 1996. Download here an updated version of the data set “On the Determinants of Economic Growth,” Holger Wolff (ed.) Proceedings of 1995 World “Exchange-Rate-Based Stabilizations: An Analysis of Competing Theories,” (with C. Vegh), “Capital Utilization and Returns to Scale,” (with C. Burnside and M. Eichenbaum), NBER Macroeconomics Annual 1995, 67-110. “Growth Effects of Flat-Rate Taxes,” (with N. Stokey), Journal of Political Economy, 103: 519-550, June 1995. “Business Cycles in a Small Open Economy,” (with I. Correia and J. Neves), European Economic Review, 39: 1089-1113, 1995. “Policy, Technology Adoption and Growth,” (with W. Easterly, R. Levine and R. King), in R. Solow and L. Pasinetti (eds.) Economic Growth and the Structure of Long Term Development, MacMillan, London, 1994. “Fiscal Policy and Economic Growth: An Empirical Investigation,” (with W. Easterly), Journal of Monetary Economics, 32: 417-458, December 1993. “Inflation in Fixed Exchange Rate Regimes: The Recent Portuguese Experience,” in F. Torres “Transitional Dynamics and Economic Growth in the Neoclassical Model,” (with R. King), “Labor Hoarding and the Business Cycle,” (with C. Burnside and M. Eichenbaum), Journal of “Marginal Income Tax Rates and Economic Growth in Developing Countries,” (with W. Easterly), European Economic Review, 37: 409-417, 1993. “Low Frequency Filtering and Real Business Cycles,” (with R. King), Journal of Economic “Business Cycles 1850-1950: New Facts about Old Data,” (with I. Correia and J. Neves) “Growth in Open Economies,” Carnegie-Rochester Series on Public Policy, 36: 5-46, 1992. “Business Cycles in Portugal: Theory and Evidence,” (with I. Correia and J. Neves), in Amaral,

Lucena e Mello (eds.) Portugal Toward 1992, Kluwer Academic Publishers, 1992. “Long Run Policy Analysis and Long Run Growth,” Journal of Political Economy, June 1991, 99: 500-521. “Public Policy and Economic Growth: Developing Neoclassical Implications,” (with R. King), “Production, Growth and Business Cycles I: The Basic Neoclassical Model,” (with R. King and C. Plosser) Journal of Monetary Economics, March/May ,1988, 21: 195-232. “Production, Growth and Business Cycles II: New Directions,” (with R. King and C. Plosser)

|

||||

|

||||