Entrepreneurs build great businesses. We help build great entrepreneurs.

Game changing. World changing. People changing. There are many paths to becoming an entrepreneur: start from scratch, buy a business or finance the next big disruptor. At Kellogg, we know being an entrepreneur is a calling, a journey — and it doesn’t end when you get your diploma. Put simply: Do we grow great ideas? Sure. But it’s the people behind those ideas that we like to nurture to success first. Let us help you define your entrepreneurial path.

An MBA program built for entrepreneurs

Empowering Kellogg entrepreneurs

Learn from scholars and real-world entrepreneurs

Meet Our Key Donors

Larry and Carol Levy established the Larry and Carol Levy Institute for Entrepreneurial Practice at Kellogg in 2012. Larry has generously continued to support newly minted as well as scaling entrepreneurs.

Learn more.

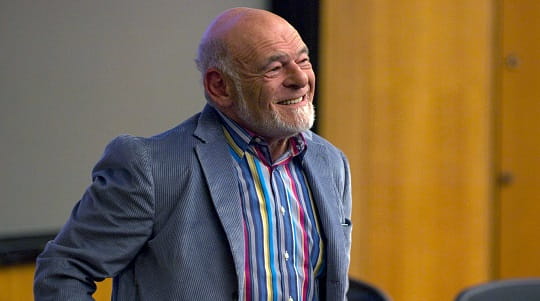

Sam Zell funds entrepreneurship program world-wide, believing in uniting the students and alumni and actively providing connections, opportunities, mentorship and support.