|

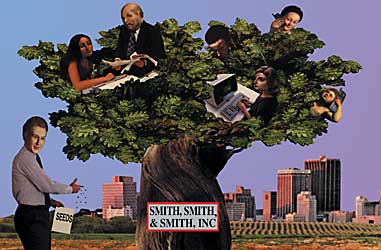

Family

valuations

The

challenges confronting family business find solutions at Kellogg,

thanks to a powerful research center and a leading expert

on the world's original business model

by

Matt Golosinski

|

| ©2001

Joan Hall for Kellogg World |

You would

probably think twice before spending Thanksgiving dinner with

your boss, no matter how fond you might be of that person

who paged you three times last weekend while you shopped for

tile at Home Depot. Yet a significant portion of the world's

business community not only breaks bread with their CEO, they

may also ask her which color tile looks best in the bathroom.

Welcome

to the world of family business, replete with fascinating

challenges largely unknown to those treading the halls of

public corporations.

"With

family businesses, you have manager relationships that last

a lifetime," says Professor John Ward, co-director of

the Kellogg-based Center for Family Enterprise. Ward is an

international authority on family business who has written

three textbooks and a dozen substantial booklets on the subject.

"I've concluded that the characteristics of the family

more profoundly affect the outcome of an enterprise than the

classical business issues," he adds.

To illustrate

the point, imagine General Electric CEO Jack Welch holding

court in the corporate boardroom, fire leaping from his tongue,

his eyes flickering with another cost-cutting stratagem. Now

imagine Welch is your father and you're one of his senior

executives charged with the task of convincing the corporate

legend that his latest idea belongs in the ashcan. It's not

a picture that inspires yogic tranquility. But this scenario

does reveal the complex, and emotional, governance issues

that Ward says confront family businesses.

"Governance

issues, succession issues, product life cycles." Ward

ticks off a list of hurdles that distinguish family business

leaders from their public company peers. These challenges

make family business a compelling study for Ward and Lloyd

Shefsky, clinical professor of managerial economics and decision

sciences, and the center's co-director.

In a Kellogg

course titled Family Enterprise: Issues & Solutions, Ward

and Shefsky introduce students to an arena unfamiliar to many.

The course was launched last year as a five-week program and

is already so popular that its length and enrollment have

doubled. "Family business studies at Kellogg will provide

valuable tools to faculty teaching a variety of seemingly

unrelated subjects," says Shefsky.

Some may

be surprised to learn that family business is not just some

mom-and-pop pizzeria tucked into a crumbling row of brownstones

back in the old neighborhood. Many family businesses are actually

household names. "Levi Strauss is a family business,"

Ward explains. "So are S.C. Johnson, the New York Times

and Ford Motor Co. Family businesses make up a huge percentage

of the biggest companies in the world."

In the

classroom, the professors not only identify the issues facing

family business, they develop theories about how these companies

behave. Ward and Shefsky are especially interested in how

family character and values -- including ethnic or religious

structures -- shape the conduct and strategy of a business.

The class draws significantly upon live case studies. Shefsky

notes that there's a "desperate lack" of these studies

for family business, so the research at Kellogg affords the

school a chance to grow its reputation in this area. One case

used in the course features a Kellogg alum who is part of

a business that transformed itself from a traditional publishing

company to one that includes a high-tech component. "This

is a great case that lets us explore how businesses are born

within businesses," says Ward.

While

Ward didn't invent family business -- the institution goes

back thousands of years -- he has popularized the subject

as an academic area. Two decades ago, Ward, a strategic planner

by training, grew fascinated by his initial foray into family

business and wanted to learn more. "So I did what any

good researcher would do," he recalls. "I went to

the library to read what had been written on the subject.

What I found was that virtually nothing had been done in this

area. That fascinated me even more."

Ward claims

that the "major institution" in the world's economy

had been ignored by most academics for two key reasons: the

intensely private nature of many family businesses, coupled

with a bias against these companies among scholars.

"Around

1930, the attitude of business education was to professionalize

business," says Ward. "This became a powerful paradigm

that not only made the inference that family businesses were

poorly run, but that the role of schools was to prepare people

for careers in publicly owned, professionally managed businesses."

This situation

has changed today, in part due to the efforts of people like

Ward and Shefsky, and the Center for Family Enterprise, founded

in 1998. The center studies every aspect of family business,

including successorship. "One thing that's unique for

leaders of family businesses is that typically they're following

in the footsteps of a relative, a parent perhaps -- maybe

a real hero," says Ward. "There's a legacy effect,

but there's also a great challenge of following someone who

was a great founder."

In America,

legacy is measured with a cultural yardstick that varies from

that used elsewhere. If an American family business matures

through three generations it's considered "high risk,"

says Shefsky. In some countries such a company would be considered

fledgling. "While teaching in Japan, a man asked me a

question about his family business," the professor recalls.

"I asked him what generation he represented. The 14th,

he told me. I was dumbfounded. I replied 'That's older than

my country!'"

In addition

to growing the Family Enterprise course, Ward and Shefsky

have worked to produce a groundbreaking executive education

program. Classes will begin this fall with a Nov. 27-30 course

on family governance at the James L. Allen Center. A weekend

conference is slated for next May. A major goal for the center

involves identifying and developing a network of alums worldwide

and establishing a database of family business scholars and

professionals. "A big priority for us is building a proprietary

Internet communications system for alums to reach each other

and to exchange ideas and share questions," says Ward.

Ward's

passion for family business stems from his belief that these

institutions play an important role the world over. In most

societies, he contends, the leaders of these businesses are

also the leaders of organizations that provide community stability.

"There's

a social dimension to all this," Ward says. "It's

not just about the fascination of learning how these organizations

overcome their challenges. The deeper question is: Are family

businesses good for society? My opinion is that having a rich

diversity of ownership systems is good."

|