| |

|

| |

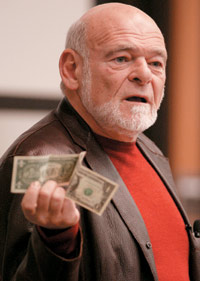

Keynote

speaker Sam Zell shows conference attendees what companies

stand to lose if they betray the trust of shareholders. |

| |

|

Kellogg

research centers explore challenge of repairing corporate

image and rebuilding trust after scandals

“Trust

me.” Easy to say, not so easy to earn after a firm loses

the faith of the investing public, according to experts at

a recent Kellogg School conference on financial trust.

Rebuilding

the confidence in financial institutions shattered by corporate

accounting scandals is a necessary step for the United States

to continue to prosper, agreed corporate and academic leaders

who met April 24 and 25 at the Kellogg School’s James

L. Allen Center for the “Conference on Trust in Finance.”

“If

people cannot trust one another, trade, investment and economic

growth will all suffer,” said John Boyd, an economist

who is chair of the finance department at the University of

Minnesota. Boyd said many of the most prosperous nations —

Switzerland, Sweden and the Netherlands — are also those

that score the lowest in corruption.

The conference,

co-sponsored by the Zell

Center for Risk Research and the

Ford Center for

Global Citizenship at Kellogg, examined the

role of financial institutions in building and maintaining

public trust, as well as ways to repair and rebuild that trust

once it has been lost or damaged. “Trust in Finance”

is part of a series of Kellogg conferences that will examine

the economy through the lens of risk management.

“Enron

taught us that you can create an environment that encourages

breaches of trust, but it still comes down to individuals

creating that environment,” said Samuel Zell, chairman

of Equity Group Investments LLC, whose gift established the

Zell Center for Risk Research. “You need consistency

and predictability to create a culture of trust. Predictability

helps generate trust.”

Other

keynote speakers included the Honorable Neil F. Hartigan,

justice of the Illinois Appellate Court; and Charles D. Ellis,

senior adviser with Greenwich Associates. Panelists and attendees

included leaders from business and academia.

Panelist

Barbara Ley Toffler, adjunct professor of management at Columbia

University Graduate School of Business, described a “culture

of denial” that existed at companies such as Arthur

Andersen and that still exists at many companies today, she

said. Toffler said many firms know of potential scandals months

— even years — before they come to the attention

of the public, but choose not to fix them.

“Until

this is addressed broadly across the (accounting) industry,

I don’t think we’re going to see very much change,”

Toffler said.

Toffler

had another message for leaders of financial institutions

who are serious about reform: “Don’t shoot the

messenger. Welcome the people who bring you good information.”

But fixing

trust, Zell said, is no easy feat.

“How

do you fix trust? It’s extraordinarily difficult to

do. There are no simple formulas, primarily because the damage

done is not necessarily definitively measurable.”

Other

speakers offered positive examples for companies to follow.

Jamie Dimon, chairman and CEO of Bank One Corp., gave details

of the turnaround he has led at his company since joining

it almost three years ago.

Among

other things, Dimon has helped the firm fortify its balance

sheet, improve customer service and generally become more

efficient. The company also has instituted strict governance

policies, including the requirement that directors meet twice

a year without management present, and was one of the first

corporations to expense options.

Dimon

also said he makes a practice of sharing the same facts with

everyone who has a stake in Bank One’s future.

“Shareholders,

employees, board members — they all get the same information,”

he said.

—

MG and KR |