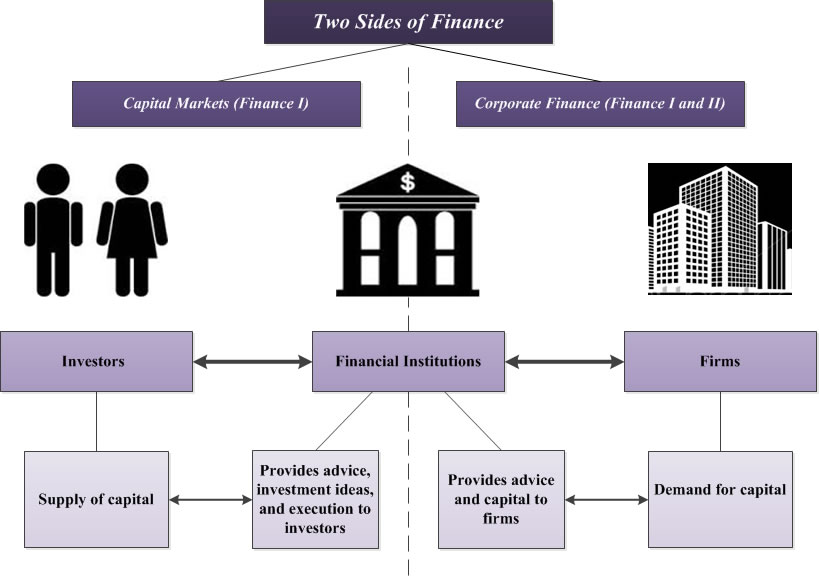

The world of finance can be divided into two sides: capital markets and corporate finance. This dichotomy appears in the courses you will focus on, the careers you will pursue, and the kinds of finance questions you will confront in your careers and classes. This is true whether you pursue a finance career or not. Use this dichotomy to guide you on which finance courses should be your focus.

Capital Markets/Asset Pricing:

Capital markets is the supply side of finance. It takes the perspective of someone who has money to invest. This can be you saving for retirement, a professional that advises wealthy clients how to allocate their portfolio, a mutual fund portfolio manager, or a hedge fund partner. These individuals must decide how to allocate their capital -- both which asset classes and geographies, but also which individual securities. In these positions, you must understand how risk is measured and managed, how expected returns are estimated, and how securities (stocks, bonds, and derivatives) are priced. You will also use financial securities or derivatives to modify your portfolio's risk (i.e. hedge or speculate). You may also be called on to design new securities from scratch.

Careers: Students who focus on the capital market courses are usually planning careers in professional money management. This includes the sell side of banks (sales, research, and trading), the buy side of the industry (mutual funds, hedge funds, endowments, family offices) or advising wealthy individuals (private wealth management). For students that are interested in managing their own portfolio, but not as a career, the Capital Markets class (FINC950) is a good choice.

Corporate finance is the demand side of finance. It takes the perspective of a firm or an entrepreneur. This is the finance of how to run a firm, yours or someone else's. There are three financial decisions which a firm, or the person who is running the firm (e.g. CFO or CEO), needs to make. You need to decide which project the firm should invest in. This is the investment or capital budgeting decision. You need to decide how to fund the firms' investment projects. This is the capital structure decision. Finally, you need to decide what to do with the earnings of your projects. Do you retain the cash and reinvest, or do you pay it out to investors as dividends or stock repurchases. This is the payout decision.

Careers: Students who focus on the corporate finance courses have a variety of career objectives. Some plan to work for financial intermediaries (lenders, investment banks, or financial advisory firms). Some students plan to work in consulting and assist firms with strategic decisions that have large financial implications (do you enter a new country by buying a firm or building up capacity internally). Some students plan to work for non-financial firms in a finance capacity (CFO or business development) or a non-finance capacity (strategy, business development, or someday CEO). You can’t manage a firm if you cannot explain why the firms should invest its capital in its strategy. Some students plan to start their own firms (entrepreneurship) and thus want to understand the finance so they are not taken advantage of by others. Some students are interested in investing in private firms (venture capital and growth/private equity). In all of these careers you need to understand both the investment as well as the financing decision.

When you turn to faculty for advice, you should look for faculty whose teaching, and possibly their research, is in the same area as your career. If you are interested in a career in institutional money management, the faculty that teach the capital market courses are an excellent resource.